- Salaries checked

- 5949 clients

- Maximum Compensation *

- 11,564,974 ₪

What we check

-

Pension Fund Contributions

Contributions paid to pension funds for the period worked by an employee to the benefit of national or private employer, or pension fund contributions for a self-employed person.

-

Annual Paid Leave

Under the Annual Leave Act of 1951 (hereinafter referred to as leave) each employer shall give leave to the employees, so that they could take a rest and have a fresh start at work. This act shall be subject to compulsory implementation. The act involves an opportunity of enlarging the leave length at the employer’s wish, but it forbids reducing the leave length covered by the act.

-

Health Care Contributions

Each employee in Israel is eligible to get health care contributions (dmei avraha in Hebrew) under the contract law. According to the law we assess the sums that the employee is entitled to.

-

Sick Leave

Under Sick Leave Act of 1976, an employee in Israel is entitled to a day and a half in a full month that the employee worked for the employer on business days missed due to illness. The amount of remuneration for the first three days of illness is the minimum fee specified in the contract law. The employer may enlarge, but shall not reduce those sums and the length of the period.

-

Overtime Pay

Overtime Pay Act of 1951 defines the hours that an employer may involve an employee. The act also defines business hours’ limits and situations that an employer may demand from an employee to go on working extra hours.

-

Holiday Pay

Payment for holidays, worked or not worked by employees, is made in accordance with employee’s religion. An employee gets paid for hours, or days, or a period that he or she worked for no less than three months at this particular job. An employee is entitled to 9 paid holidays, granted that the employee worked the day before and the day after the holiday. As a rule, employees are entitled to be absent at work on their religious holidays.

-

Transportation Fee Payment

Since 1.1.2014 each employee in Israel is entitled to transportation fee compensation up to 26,4 NIS per each business day that the employee used public transport, except for transport provided by the enterprise, granted that the distance from the employee’s home to work is no less than 500 meters or 2 bus stops. The law permits including transportation fee compensation in the overall salary accounting, granted that it is agreed between the employer and employees.

-

Advanced Training Fund

Advanced Training Fund (keren ishtalmut in Hebrew) is savings in order to have funds for the employee’s advanced training payment. Nowadays this fund is used as a saving instrument for a short period of time. Savings are tax free at the moment of their exaction from the fund. Contributions to this fund made by an employer are also tax free (but not contributions exceeding the sum of the salary). Savings may be extracted for advanced training in 3 years and for any needs - in 6 years.

-

Dismissal Letter

The law permits an employer to dismiss an employee, but the law demands from an employer to tell of the dismissal to an employee in advance in accordance with labor law. It must be emphasized that such a preliminary message is obligatory for dismissing an employee on the initiative of both - the employer and the employee.

-

Dismissal Compensation

An employee is enlisted to get dismissal compensation in the day he or she is dismissed, or had to be dismissed on his or her own initiative for reasons specified in the law, and this legal reference is compulsory for an employer. The aim of dismissal compensation law is to protect an employee in accordance to labor law. It enforces the bond of an employee with his or her job place; it allows an employee to look for another job without headache and reminds an employee that if he or she quits the job on his or her own initiative, the employee would lose right for the dismissal compensation.

- Rate per hour

- 32.31 ₪

- Rate per day 5 business days a week

- 271.39 ₪

- Rate per day 6 business days a week

- 226.15 ₪

- Rate per month

- 5880.02 ₪

- Transportation fees per day

- 22.6 ₪

Minimum salary above the age of 18 years.

Valid for  19/04/2024

19/04/2024

Your job rights

Add your e-mail to our mailing list and get all important information directly onto your mail address: news and changes in labor law, general law, collective arrangements and/or new annexes, articles, important details allowing employees to control their salary pay sheets, etc.

Example

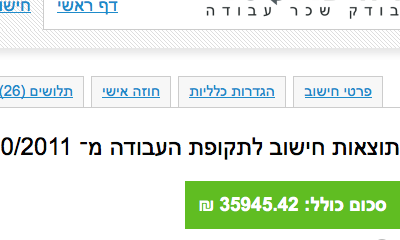

Please find here an example of salary accounting and social contribution revision with the help of TlushDin. Compensation is 35,945 NIS.

The conducted review brought the case to the court.

Testimonials

Hello, my name is Alex. I have been working at Check Post near Haifa for 6 years. I had to

quit my job, for my employer didn’t pay me for overtime job, didn’t give me work breaks and didn’t pay me for holidays, as the law demands.

With the help of TlushDin I calculated everything I’m legally entitled to, then I turned to the lawyer, who appeared for the court against my employer. The court found that I’m entitled for compensation both for dismissal from job and for overtime working hours.

I got 36.000 NIS in total.

Hello! I turned to the lawyer, who took my case – a claim against the employer who didn’t pay me for transport, for extra working hours, didn’t make contributions to pension fund and didn’t compensate holidays.

The district court of Nazareth accepted my suit and obliged my employer to pay me all amount owed. I got everything I owed for the relatively short period, amounting in a year and a half. The court mentioned that all calculations made via TlushDin website were correct and legal.

I worked as a cleaner in a health insurance company for 9 years. Then I quit my job, for I didn’t get payment for overtime work, didn’t get pension contributions, wasn’t paid for holidays and sick leaves.

I sent all my documents to TlushDin, received a detailed answer and then turned to the court. As a result I got 80.000 NIS from my employer.

Good morning everyone! Here’s my story. I moved from Tel Aviv to Afula. The security guards company I worked for didn’t want to give me a dismissal letter and didn’t pay dismissal compensation. I worked there for a year and a half. After I moved, I turned to the lawyer and he

filed a suit against my former employers. Thanks to TlushDin and my lawyer I got 10.000 NIS compensation, and also my lawyer got 2.000 NIS from my ex-employees for my legal costs.

Employees

Employees Lawyers

Lawyers Employers

Employers Auditors

Auditors